15 Best VoC tools for product analytics: compare use cases, and ROI

%20tools%20for%20product%20analytics.webp)

In this guide

✧

Example H2

This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

P&L roadmaps don’t move on dashboards alone. Product analytics tells you what changed, but it is the Voice-of-Customer (VoC) analysis that shows why it changed: across calls, chats, tickets, reviews, social, and in-app prompts.

The best VoC platforms for product analytics do three things consistently:

Capture signals across channels and languages.

Explain root causes with transparent, AI-powered, actionable insights.

Act by pushing evidence into backlogs and proving outcomes.

👉In short: collection → analysis → action—beyond surveys alone to include diverse Voice-of-Customer (VoC) signals.

The best Voice of the Customer platforms summary: features and fit comparison table

Vendor

Product analytics sweet spot

What to verify first

Full VOC analysis, assortment gap analysis, competitive product analysis, and demand gap identification

Time-to-answer on 3–5 “why” questions; theme cluster quality.

Discovery + in-product feedback + AI agents

Product-only workspace; Text iQ speed/stability; agent → ticket flow.

Omnichannel + closed loop across product/care/digital

Product workboards; integrations; AI/assistant explainability.

Research rigor + prescriptive VoC; post-acquisition breadth

Roadmap clarity; recs → owned work; journey → usage flags.

Text at scale (tickets/chats/reviews) → drivers; Lyra features

Root-cause grouping; pre/post views; 2-click traceability.

Survey discovery + in-app/mobile; Pulse AI on open-ends

Auto-tagging to taxonomy; multilingual; backlog handoff.

Voice → product fixes with frontline context

ASR accuracy/latency; snippet export; beyond-voice coverage.

Hands-on topics for surveys/reviews; steerable themes

Theme stability; drift/versioning; multilingual + easy exports.

Social/community signals into product

Social → prioritized tasks; app-store/forum coverage

Voice-led insight; effort detection; data mapping

Accuracy/latency; evidence clips; unify with tickets/reviews.

In-product/journey surveys; native Salesforce mapping

Triggers/targeting; open-end analytics; SFDC mapping

VoC + account health + PX; in-app nudges

Health inputs; PX targeting/experiments; ARR linkage

Observed behavior + video clips; pre/post validation

Panel targeting, clip embedding, and turnaround SLAs

Reviews-first VoC for multi-location; response + benchmarks

Site coverage; dedupe rules; owner routing

Unified reviews/surveys/social; exec Reputation Score

Score method workflow; drill-downs; integration availability

From feedback to roadmap: how VoC platforms power product analytics

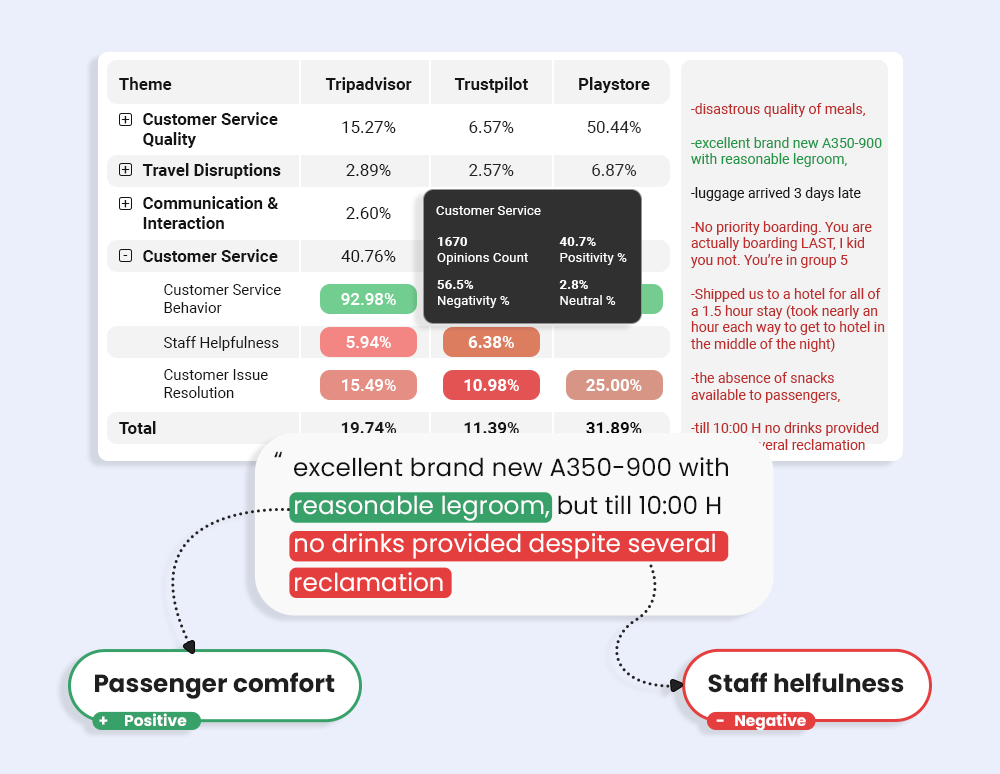

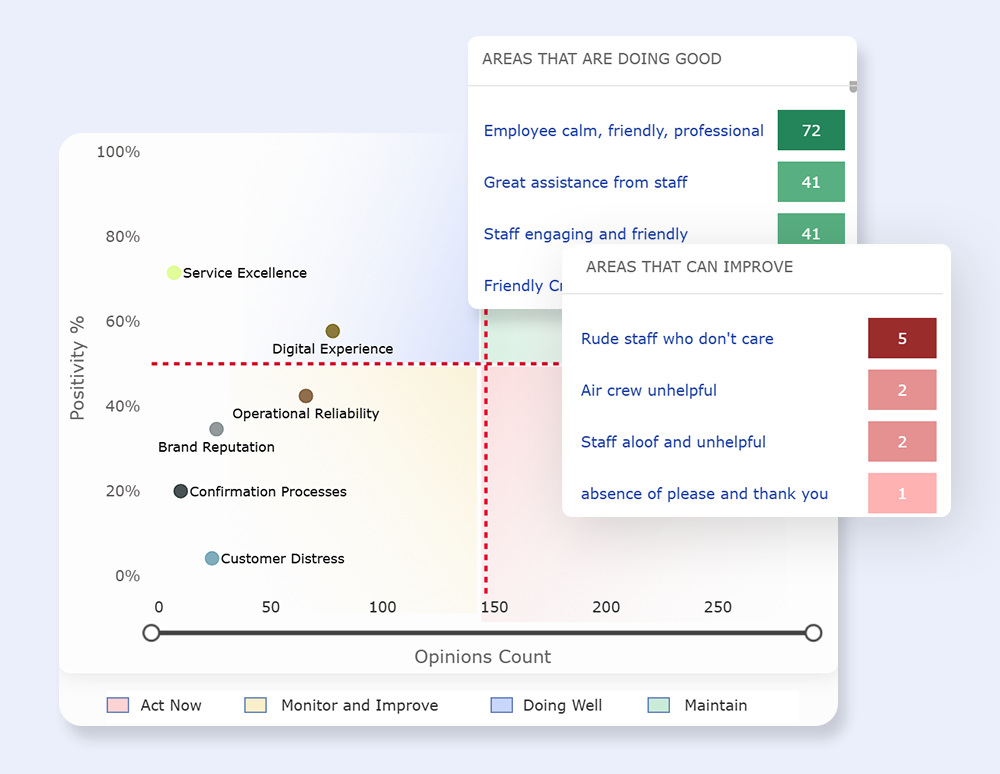

Clootrack: Multi-level drill-down reporting

Root-cause clarity, not keyword clouds. Unsupervised theme discovery groups scattered comments into drivers. This gives PMs drill from trend to the exact clip/snippet.

Release-aware diagnostics. Compare pre- and post-sentiment and sub-themes to pinpoint regressions after a version ships.

Evidence-first prioritization. Rank by volume × intensity × impact so trade-offs aren’t opinion wars; link every driver to verbatim evidence.

Closed loop to build tools. Push to Jira/Linear with owner/SLA; notify Slack/Teams; track “resolved driver → KPI delta.”

Clootrack: Prioritization matrix with actionable insights

Now let’s discuss the top 15 VoC tools for product analytics.. The tools have not been listed in a ranking order; rather, we have focused on what it is (product overview), where it fits, and why buyers choose it, so you can compare apples to apples.

Top 15 VoC tools for product analytics

1. Clootrack

Clootrack analyzes 100% of VoC - calls plus free-text from tickets, chats, reviews, email, social, and in-app - without manual tagging. Its patented unsupervised theme discovery organizes feedback into multi-level themes (theme → sub-theme → sentiment/emotion) and ranks them by volume × intensity × business impact.

Every driver traces back to the raw verbatim or time-coded call moment, so PMs can paste evidence into PRDs or attach it to Jira/Linear. By leaning on unsolicited signals, Clootrack reduces survey dependency and delivers a 360° view of customer behavior.

🎯 Where it fits best?

Clootrack is a strong fit for enterprise and global teams buried in tickets/chats/reviews and battling churn because it turns that noise into ranked, explainable drivers with verbatim proof.

For release-heavy products, it gives pre/post version views to isolate regressions and prioritize by revenue risk, not just volume—so questions like “Why did cancellations spike after v7.3?” get answered fast.

It also meets enterprise needs with SSO/RBAC, audit trails, and regional data residency/VPC options, keeping governance tight while you move quickly.

✅ Why buyers pick it?

Clootrack turns messy tickets, chats, reviews, and calls into ranked, explainable drivers with click-through verbatims/clips—so PMs can defend priorities and ship faster. Its hidden purchase intent detection (upgrade cues, price blockers, cross-sell interest) ties themes to segments and guides packaging and rollouts.

Buyers value its tunable impact model that steers work toward revenue risk or opportunity, and the closed loop—bi-directional Jira/Linear plus pre/post KPI deltas—that help in P&L impact tracking.

Get AI-powered product insights with customizable AI agents →

2. Qualtrics

Qualtrics is an enterprise XM stack combining in-product feedback, surveys, and Text iQ for topic/sentiment modeling, plus conversation intelligence—so PMs can mine open text and interaction data and align it with cohorts/segments. It centralizes solicited and unsolicited feedback for decision-ready drivers.

🎯 Where it fits best?

Large organizations running discovery, post-release studies, and CX programs under one governed roof—ideally with a product-only workspace so PM signals don’t drown in ops noise.

✅ Why buyers pick it?

Qualtrics combines ecosystem breadth and a deep partner network with stakeholder-ready reporting that travels well from squad to exec. Its Text iQ and conversational feedback give mature open-text analysis (with useful industry models), while enterprise governance and tight integrations with major CRMs, helpdesks, and data warehouses make it easy to standardize VoC across teams and regions.

3. Medallia

Medallia is an omnichannel VoC platform with mature closed-loop execution across product, care, and digital. This AI-powered tool helps in surfacing trends, performing root-cause analysis, and compressing analysis time (e.g., Ask Athena, summaries, smart responses). Built to take action, routing insights across product, care and digital.

🎯 Where it fits best?

Multi-brand, multi-region enterprises where product change must coordinate with service workflows and operations.

✅ Why buyers pick it?

Scale + mature closed-loop capabilities. Leaders value that insights move to owned work with traceability, and that impact can be tied back to cohorts and KPIs across teams.

4. PG Forsta (incl. InMoment)

.webp)

Research-rigorous VoC with prescriptive guidance and journey visualization—useful when you run formal research alongside always-on feedback and need strong methodology plus services. Press Ganey Forsta acquired InMoment (May 14, 2025), expanding omnichannel/AI coverage.

🎯 Where it fits best?

Complex environments where methodology and services matter as much as software, like healthcare, financial services, and multi-region retail.

✅ Why buyers pick it?

A consultative path from recommendation to owned work, with a broader module map—appealing when product decisions need methodological confidence and prescriptive clarity.

5. Chattermill

Chattermill is an unstructured-text specialist (tickets, chats, reviews) that turns messy feedback into product drivers with verbatim traceability. The Lyra suite (Ask Lyra, Highlights, Observations) helps PMs jump from trend to actionable issue quickly.

🎯 Where it fits best?

SaaS and consumer apps where text is the primary “why,” and release cadence is high. It blends public signals (ratings/reviews) with support text, making it easier to argue for a fix—and to show before/after movement after you ship.

✅ Why buyers pick it?

Clear driver framing and fast trend → example navigation that travels well in PM/Exec conversations; buyers like the balance of scale and transparency in the evidence.

6. Alchemer

Alchemer is a survey-first platform that’s matured into a credible VoC option for product teams—especially where in-app/mobile prompts matter. What makes its coverage pop are Alchemer Pulse (AI text analytics for sentiment/intent/themes) and the earlier Apptentive acquisition that strengthened mobile feedback capture.

🎯 Where it fits best?

Alchemy is best for research-led orgs running lightweight discovery alongside always-on listening. Typical motion: trigger contextual prompts after key flows, synthesize open-ends with Pulse, compare pre/post release deltas, and hand off theme-tagged items to product owners. If your backlog discussions hinge on “what changed in the latest drop?” Alchemer keeps the research loop tight.

✅ Why buyers pick it?

Flexible study design + practical text mining without heavy DS overhead; strong mobile capabilities and integrations make it easy to operationalize feedback across product and research.

7. Calabrio

Calabrio is a contact-center native (QM/WFM/analytics) with a VoC layer that’s excellent when voice is your dominant “why.” The strength is adjacency: analytics sit alongside frontline context, so Ops and Product see—and fix—the same issue in the same week.

🎯 Where it fits best?

High-volume call environments where speech accuracy, latency to insight, and clip-level evidence matter. If you need to prove a UX defect with audio, not anecdotes, Calabrio’s positioning resonates. If your feedback mix expands beyond voice, check how tickets/reviews unify so PMs don’t tool-hop.

✅ Why buyers pick it?

Voice depth + operational adjacency: makes it easier to turn call evidence into prioritized backlog items that stick through review.

8. Caplena

Caplena is an AI-assisted topic-modeling tool for surveys and reviews with user-steerable themes. It appeals to hands-on PM/UXR teams that want to guide taxonomy rather than accept a black box; it also has broad language coverage and fast imports from common sources.

🎯 Where it fits best?

Survey/review environments that are rich in features, needing sentiment analysis and quarter-over-quarter comparability. Teams use Caplena to quantify sentiment at the feature level and export clean summaries for PMM, UXR, and exec decks.

✅ Why buyers pick it?

Hands-on control + fast time-to-insight; easy imports and sharing suit PM/UXR workflows where multiple stakeholders must explore the same findings.

9. Sprinklr

Sprinkler is a unified CXM suite that’s particularly strong where social/community and digital care signals shape your roadmap. Sprinklr’s Insights product aggregates consumer and competitive intelligence across many channels.

🎯 Where it fits best?

Brand-heavy, community-active products where public chatter (forums, app-stores, social) drives support load and product priorities.

✅ Why buyers pick it?

Scale of external coverage + workflows that route signals to product owners, reducing swivel between social tools and VoC.

10. Verint

.webp)

Verint is a voice analytics powerhouse long used in high-volume contact centers and increasingly tied to product UX fixes (e.g., customer effort detection, advanced data mapping, AI-led outreach triggers). It’s voice-led analytics transcribes and analyzes 100% of recorded calls to surface themes, effort, and sentiment—paired with automation and bots that route actions.

🎯 Where it fits best?

Enterprises with strong contact-center roots wanting audio evidence and product+service alignment from the same platform.

✅ Why buyers pick it?

Mature speech analytics, operational context, and evidence clips PMs can use to justify fixes, helpful when the “why” primarily lives in calls.

11. SurveyMonkey

.webp)

SurveyMonkey pairs journey/in-product surveys with native Salesforce mapping, so responses land on objects/fields teams already use. Open-ends can be analyzed and reported directly in CRM alongside operational data.

🎯 Where it fits best?

Salesforce-centric orgs that want fast, contextual prompts and structured analysis, without spinning up a heavyweight VoC program. It offers reliable real-time reporting and adoption in SFDC.

✅ Why buyers pick it?

Speed + CRM alignment: survey operations and reporting live where sales/success/product already work, keeping action and analytics tightly coupled.

12. Gainsight

Gainsight connects VoC, customer success, and product experience (PX): it captures feedback, links to account health, and acts with in-app guides and engagements. PX brings product analytics and targeted nudges/testing.

🎯 Where it fits best?

B2B SaaS where product priorities must reconcile with renewal risk, adoption, and expansion at the account level.

✅ Why buyers pick it?

Clear account-level linkage from VoC to revenue, plus the ability to act inside the product and watch health/adoption move, without hopping tools.

13. UserTesting

.webp)

UserTesting platform complements text/voice analytics with observed behavior: moderated/unmoderated tests, task success, and video evidence you can clip into PRDs and sprint reviews: turning “why” into something stakeholders can watch.

🎯 Where it fits best?

Digital journeys (checkout, onboarding, mobile) where seeing the moment of friction beats inferring from tickets/surveys; useful for pre-release diagnosis and post-release regression checks.

✅ Why buyers pick it?

Fast access to targeted panels + shareable video proof that wins roadmap debates; accelerates validation while reducing rework.

14. Birdeye

Birdeye is a reviews-first VoC and reputation platform for multi-location brands that helps in aggregating, analyzing, and responding to reviews across 150+ sites, as well as social listings and analytics. For product/ops, it’s a rich stream of public feedback you can mine for recurring defects and regional patterns.

🎯 Where it fits best?

U.S. multi-location businesses (retail, healthcare, services) where public reviews drive discovery/conversion and need to feed product and field operations.

✅ Why buyers pick it?

Coverage + operational muscle around reviews: response workflows, trend analytics, and location benchmarking that connect reputational signals to product and ops actions.

15. Reputation

Reputation unifies reviews, surveys, social, messaging, and listings with AI-driven insights and a proprietary Reputation Score that rolls performance into a single KPI with drill-downs to verbatims/locations.

🎯 Where it fits best?

Enterprises with brick-and-mortar or multi-region footprints (auto, healthcare, retail, hospitality) needing public + private feedback reconciled into one scorecard, then routed to accountable owners.

✅ Why buyers pick it?

A mature reputation + VoC stack with competitive/location benchmarking and an actionable KPI (Reputation Score) that correlates to commercial outcomes and travels well with executives.

👇 Bonus tip!

Pick 2–3 vendors from your likely lane (voice-led vs. text-led vs. research-led). In discovery call sessions, ask them to answer these five product questions on your data; score time-to-answer, traceability (2-clicks to evidence), handoff quality, and prioritization logic:

Why did cancellations spike after the latest version?

What are the top three friction drivers in mobile checkout?

Which regions/languages show the biggest complaint intensity gap?

Which themes correlate with returns/refunds post-holiday?

Create a Jira/Linear ticket from a driver, with owner/SLA and a live link to the evidence.

Examples of successful VoC use cases in product analytics

Here are some of the most practical VoC applications that directly translate into informed product decisions and measurable outcomes. Each example maps signal → action → metric, allowing you to integrate them into your CX strategy and roadmap for greater impact.

Real-time sentiment and emotion analysis on calls, chats, and reviews to spot emerging issues during releases.

Automatic theme discovery and root-cause detection from unstructured data (call transcripts, support tickets, reviews).

Churn prediction by tracking early-warning drivers (e.g., repeated failure, billing confusion) and flagging at-risk cohorts.

Analyze bug detection by correlating ticket/review keywords with funnel drops, and then fix and track the conversion lift.

Pre-and post-release comparisons of sentiment and themes to identify onboarding regressions quickly.

Capability gaps from transcripts (e.g., “need SSO”): validate demand with a quick in-app prompt, then add to the roadmap.

Billing friction themes surfaced from feedback: simplify renewal/invoice flows and measure the drop in cancellations.

Revenue-intent detection (upgrade/buy signals, price sensitivity) to guide packaging, add-ons, and targeted rollouts.

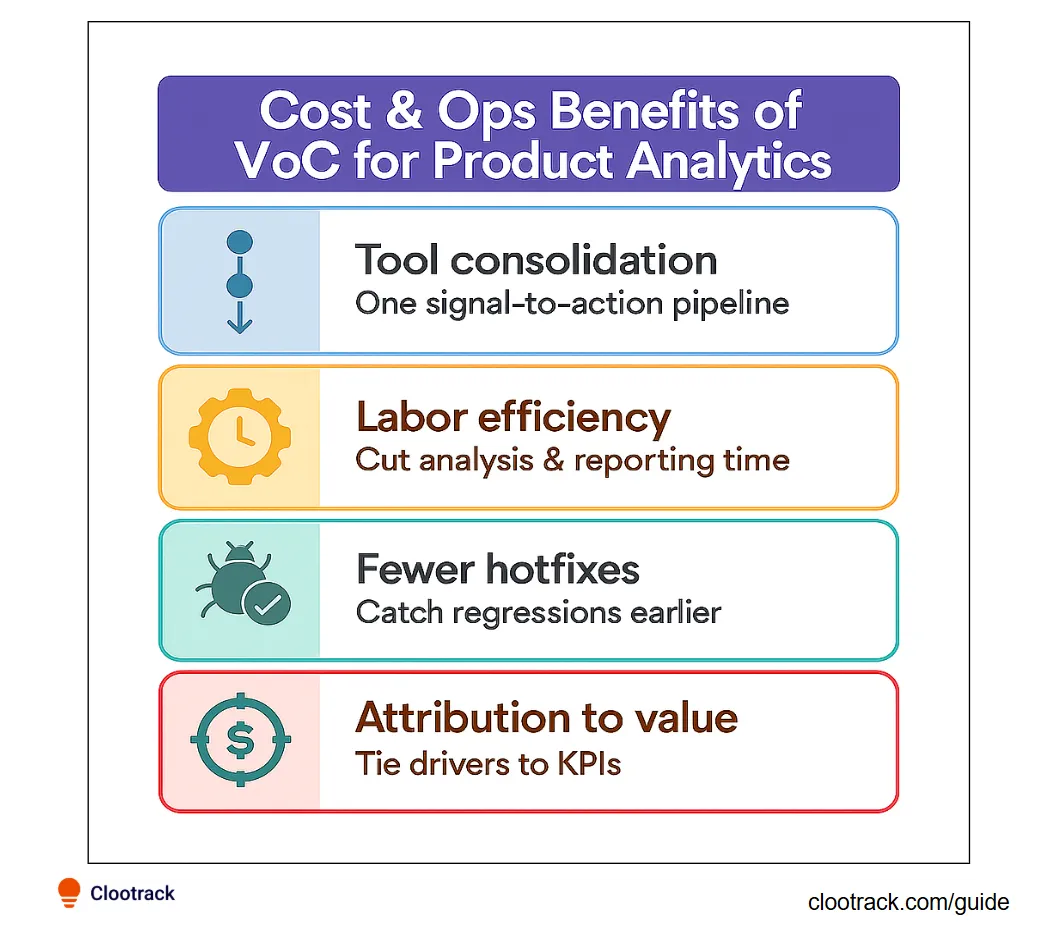

Cost and ops benefits of VoC tools for product analytics

Tool consolidation. Replace separate survey add-ons, manual coding, and bespoke reporting with one signal-to-action pipeline.

Labor efficiency. AI summaries/drivers save analyst hours and PM reporting cycles.

Fewer hotfixes. Catch regressions earlier; reduce re-releases and incident churn.

Contact-center impact. Product fixes sourced from VoC data reduce repeat contacts/AHT and improve FCR over time.

Attribution to value. Tie closed drivers to churn, conversion, and returns for hard ROI, an emphasis echoed in current vendor/analyst materials.

Frequently asked questions (FAQs)

What is Voice of the Customer (VoC) in product analytics?

Voice of the Customer (VoC) refers to the systematic process of collecting and analyzing customer feedback to understand their expectations, preferences, and pain points. In product analytics, it complements quantitative data by revealing the “why” behind user behaviors and retention patterns.

Why is VoC important for product teams?

VoC gives product managers clarity on what customers truly value, guiding roadmap priorities and feature development. It helps reduce churn, increase satisfaction, and ensure that product improvements align with real user needs—not assumptions.

How does VoC improve product strategy?

VoC analytics improves product strategy by identifying recurring friction points in journeys and uncovering unmet needs from open-ended feedback. AI-powered VoC analysis helps prioritize impactful product fixes and enhancements—improving retention, loyalty, and feature adoption.

What are examples of successful VoC use in product analytics?

Here are some examples of successful VoC use in product analytics:

Spot a checkout bug from support tickets and app-store reviews, then fix it and track the conversion lift.

Compare pre-/post-release sentiment to catch a regression in onboarding.

Use call transcripts to identify a missing capability, validate the demand, and then add it to the roadmap.

Flag churn risk themes (e.g., billing confusion) and measure the drop in cancellations after a fix.

How to integrate VoC data with product analytics

Focus on connecting customer comments with behavioral data to understand the "why" behind user actions. Here’s how an AI-powered VoC tool integrates VoC data for product analytics:

Centralized data sources: tickets, chats, calls, reviews, in-app prompts, surveys.

Links to customer behavior: Connects themes to events, funnels, and cohorts.

Push to work: creates Jira/Linear items with owners and SLAs.

Report outcomes: shows before/after changes in conversion, ARPU, retention.

What features should a VoC tool have for product analytics?

Must-have features in a VoC tool for effective and ROI-driven product analysis:

Multi-channel capture: voice + text (tickets, chats, reviews, in-app).

AI discovery: unsupervised themes, sentiment/emotion, root-cause grouping.

Explainability: click into the verbatim/clip behind each insight.

Prioritization: score by volume × intensity × business impact.

Closed loop: native handoffs to Jira/Linear and alerts in Slack/Teams.

Governance: SSO/RBAC, PII controls, data residency.

How do I get started with VoC for product analytics?

Follow these steps to get started with an impactful VoC strategy for product analysis:

Set goals: e.g., “Cut checkout drop-offs by 20%.”

Ingest 3–6 months of tickets/reviews/calls; verify language/ASR quality.

Map themes → journeys: tie drivers to funnels and cohorts.

Pick the top 3 fixes by impact, assign owners and SLAs.

Ship and measure: track pre- and post-metrics; keep only what moves the needle.

Do I need surveys to run VoC analysis?

Not always. Unsolicited feedback (such as tickets, reviews, and calls) often covers a wider range of cases and is less biased. Use short, targeted surveys only where you have gaps or need structured validation. VoC analytics helps you overcome survey bias, limited feedback data, and unreliable quality. Here’s how to capture the voice of customers beyond surveys →

Do you know what your customers really want?

Analyze customer feedback and automate market research with the fastest AI-powered customer intelligence tool.