This case study highlights the journey of a major bank as it faced the challenge of consolidating data from multiple sources. With a growing need for a centralized and integrated view of data, the bank searched for a solution that could effectively bring together data from disparate systems and provide meaningful insights.

The bank turned to Clootrack, a leading customer experience analytics platform, to address this challenge. Through its implementation of CX analytics, the bank was able to achieve seamless integration of data from multiple sources, resulting in improved decision-making, enhanced operational efficiency, and a significant increase in overall productivity.

The following case study delves into the details of the bank's journey and the impact Clootrack had on its operations.

Case Study Background

As a banking major, Bank X regularly conducts NPS surveys at various touchpoints and receives a monthly influx of 60,000+ open-ended customer responses through multiple channels, including NPS, email, chatbot, Appstore, website, and more.

The Problems of Bank X

Despite having a customer care system that ensures each query is addressed within a specified SLA time frame, the bank encountered the following challenges:

● Challenging to synchronize the efforts of various crucial departments such as Customer Care, Operations, and Marketing team.● The NPS results lacked actionable insights, leading to each department relying on distinct information to reach its own inferences.

● Attempts to take action in discussions tend to be limited to a departmental understanding of specific issues, neglecting the overall perspective.

● Lack of intentional steps taken to enhance holistic customer experience.

Data for this Case Study

Here, in this case, Clootrack considered 60,000+ customer conversations per month.

Bank X gathered customer feedback and grievances through various platforms such as open text NPS, emails, the app store, a chatbot, and their website. This information was analyzed to gain insights.

How Clootrack Helped Bank X?

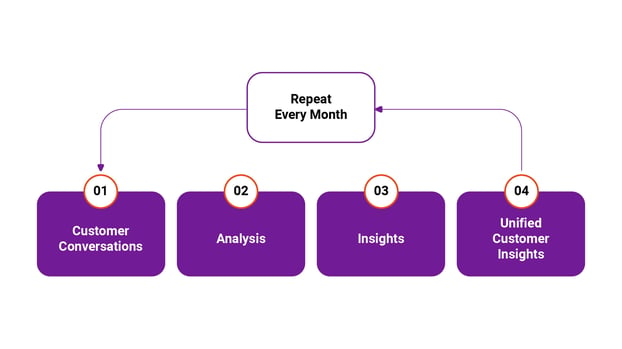

Clootrack iteratively did a 4-step monthly process.

Step 1 - Collected Customer Conversations

The first step Clootrack did was to obtain customer conversations, which can be reviews, feedback, CRM tickets, etc., from various channels, such as email, the Net Promoter Score (NPS) survey, and others.

Step 2 - Analyzed Collected Data

After collecting customer conversations, Clootrack deeply analyzed the conversations. This process involves identifying patterns and common themes, allowing organizations to understand the priorities of their customers.

For example, if many customers express concerns about extra charges, it becomes clear that cutting unnecessary expenses is their key priority. This information can then inform decision-making around service charges and fees.

Step 3 - Captured Insights

The goal of the deep analysis is to identify trends and patterns that reveal what is most important to customers, such as their preferred products, services, and experiences.

This information can then inform critical business decisions and tailor marketing and customer service efforts to meet customers' evolving needs and priorities.

For example, if the analysis reveals that customers place a high priority on convenience, companies may respond by offering more flexible payment options or by updating mobile apps that allow customers to do transactions more efficiently.

Step 4 - Presented Unified Customer Insights

Clootrack presented insights to the bank a single view of customer priorities, enabling them to understand what is most important to their customers across different channels and demographics. This information allowed the bank to make informed decisions about their products and services, ensuring they met their customers' needs and wants.

The data gathered was backed, meaning it was verified and validated through multiple sources, making it more reliable and trustworthy.

Additionally, the data was trackable to verbatims so that the brand could see exactly what customers were saying about their products and services. This allowed the brand to identify patterns and trends in customer feedback, giving them a more comprehensive view of customer priorities.

How Customer Priorities Change Over Time

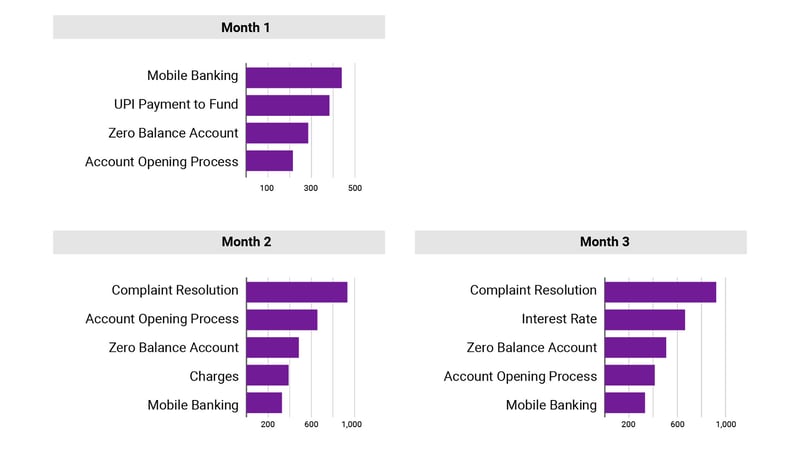

When Clootrack analyzed 60,000+ conversations and populated insights, there were significant customer priority changes in saving bank accounts over the 3 months.

Mobile banking, Zero balance account, and the Account opening process are the top drivers that come as a priority in all 3 months.

In month 1, when Clootrack dug deep, UPI payment came in as the second top customer experience driver. But, when it comes to month 2, it doesn’t even list in the top 5 drivers. Also, the top driver, Mobile banking, in month 1 has dropped to the 5th top driver in month 2.

In month 3, a new customer experience driver - Interest rate - appeared to be one of the top drivers, unlike previous months.

From this insight, we can conclude that customer experience and preferences change in the blink of an eye, even without any cues.

So tracking them is essential to make improvements in the future. Improved customer experiences will fine-tune the entire customer journey and improve customer retention and customer loyalty.

Behind The Scenes - How Were The Insights Consumed?

Month - 1

Clootrack did a deep analysis of customer conversations back and forth to identify ‘Mobile baking’ and ‘UPI payment to fund’ as the top 2 drivers.

.jpg?width=622&height=350&name=04%2001%20Blog%20Images%2003-01%20(1).jpg)

Mobile banking became the top customer priority since the sentiment among many people within the organization was that their mobile app needed significant improvements. Despite having strong branding and catchy slogans, actual actionable efforts to enhance the app was lacking.

To address these issues, the organization utilized Clootrack insights to identify and prioritize their mobile app's key areas of concern. Focused efforts were then made to address these pain points and provide a positive customer experience.

About the second driver, the technical team at Bank X was aware of a problem with ‘UPI payments to fund’ transfers. However, they didn’t understand the seriousness of the situation until the issue was highlighted as a top priority for customers through Clootrack insights. Upon realizing the gravity of the situation, the bank took prompt action to resolve the issue and ensure that UPI payment to fund transfers would be seamless for its customers moving forward.

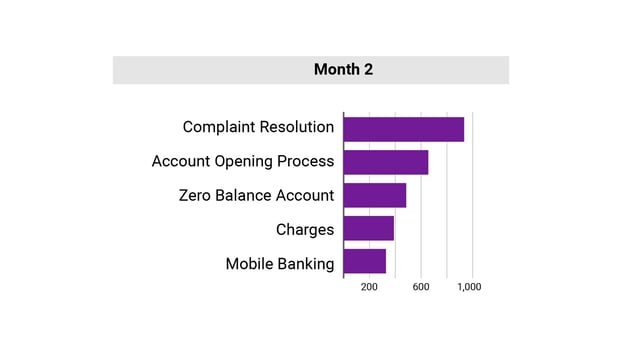

Month - 2

The previous month’s insights and the bank's action have been reflected in the next month. Let’s check them in detail.

Here, the significant change we can see is that Complaint resolution has become the top priority for customers, which is not even one of the customers' top priorities in the previous month.

Even though ‘Complaint resolution’ was raised to be the highest priority, the bank has chosen to put off addressing this issue in the current month due to operational difficulties.

This decision was made after careful analysis and evaluation of the current operational landscape, and it was deemed that focusing on other pressing matters was a priority at this time—the Charges and Account opening process for more improvements in the experience and improved customer satisfaction levels.

During the previous month, the team made a concerted effort to prioritize customer satisfaction for the Mobile banking service. Through this focused approach, they enhanced the user experience and provided a more seamless and efficient platform for the customers. The results of this hard work were evident as it came down to be the 5th priority from the 1st priority in the previous month.

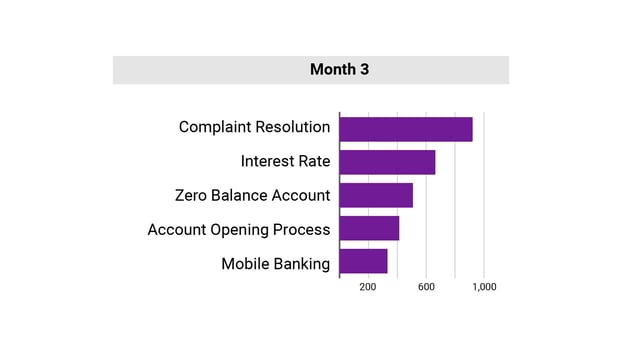

Month - 3

The significant change in month 3 was the - Interest rate - a new driver become the customers' top priority.

This is because the bank was previously known for offering some of the most competitive interest rates in the market; however, it recently adjusted its interest rate that month. This shift in interest rate policy has become a priority as it directly impacted the customers' experience.

The bank acted upon the Charges issue and the Account opening process procedure and put more attention and action.

When a brand resolves the rising customer complaints, it can retain the same or similar customers with them for a long time.

What Made the Bank To Act on Clootrack Insights?

Here is what the customer insights team of Bank X says about it.

“There are many aspects which we know issue. There are some issues only some people know in the company. There are some issues which no one knows in the company.

Clootrack is able to bring out these, if it matters to customers.”

An effective and cohesive customer experience initiative in a banking ecosystem requires collaboration and unified efforts across various departments within the organization.

This involves ensuring that all relevant teams, such as customer service, technology, and marketing team, are working towards a common goal and have a shared understanding of the specific challenge they are trying to address.

Without this level of coordination, it may be challenging to deliver consistent and seamless customer experiences, as various touchpoints within the bank may not align. By bringing departments together, the bank can ensure that its customer-centric efforts are well-coordinated, efficient, and impactful.

So, what was the role of Clootrack in this successful case?

What Makes Clootrack Insights Credible to Act Upon?

The following 4 specifications of Clootrack made this happen!

1. Backed by real customer conversations

Every customer experience insight generated by Clootrack has been substantiated by actual customer verbatim and interactions. This means that the information used to create these insights has been collected directly from the ultimate source - the customers, even though they collected from multiple online platforms!

2. Not Just a Sample of Customer Conversations

To get the holistic picture, Clootrack always gathers and analyzes thousands of customer verbatims to ensure that the insights genuinely reflect the voice of the customer. By doing so, Clootrack can provide a comprehensive and in-depth understanding of the holistic customer experience, which helps brands continually improve and enhance it.

3. Customer Verbatim Give an Outside-In View of the Brand Experience

The customer verbatim insights provide an opportunity for individuals within a business to shift their perspective and see the brand experience through the eyes of the customer.

By examining the thoughts and feedback of those who interact with the brand, this outside-in view allows for a deeper understanding of the customer's perspective, helping to shape and improve the brand experience. With a better grasp of what customers value and what they feel, businesses can work towards delivering a more personalized, fulfilling experience for all customers.

4. Supports 55+ Languages

Clootrack is a language-friendly solution that supports over 55 languages, making it easier for businesses to understand their customer base and segments in different regions.

This feature helps to capture the verbatim of their customers, preserving the emotion and flavor of the customer experience, regardless of the language they speak. With the ability to produce insights across a broad segment of customers, Clootrack provides businesses with a unique and inclusive approach to customer experience analysis.

The Impact of Implementing Clootrack’s Customer Experience Analytics

There will be a significant impact on your business and its growth rate for sure once you implement the Clootrack customer experience analytics platform.

The major impacts are:

1. Identifies key customer priorities at a macro level.

2. Data-driven insights support the harmonization of various departments.

3. Collaborative initiatives across departments aimed at enhancing the overall customer experience.

4. Elevating customer satisfaction through ongoing enhancement.

Finally, the Advantages of Clootrack’s Customer Experience Analytics Platform

It's an excellent advantage for a company when they start thinking about incorporating customer experience insights in their decision-making. Here let's check the additional benefit a brand would get when they adopt Clootrack:

1. Instead of collecting data from multiple sources and analyzing them separately, the Clootrack dashboard allows seeing all customer perceptions across various channels in a single dashboard.

2. As a client, you do not require to worry about the resources, data collection, and analysis. You will get ready-to-use actionable insights!

3. Real-time insights from Clootrack allow you not to miss the current trends of customer choices and the market.

4. Unbiased data collection and analysis leads to an impartial conclusion, which helps to make the right decisions.

5. All insights Clootrack provides are based on original customer verbatim and conversations. So no need to worry about the genuinity in insights.

6. Clootrack’s expert support team is available anytime to fix any concerns.

7. The insights are consumable and easily understandable for decision-makers.

Conclusion

Clootrack is an all-in-one solution to understanding your customers, how your brand performs in the marketplace in customers' eyes, and how your performance is compared to competitors. All these aspects can be tracked down with the solid insights provided by Clootrack that are backed by authentic customer conversations!

And tracking customer insights in Clootrack allows brands to understand current customer concerns, improve the customer journey, track their improvements, and be updated with the ever-changing trends.

Read more - How a Top Grocery Delivery Brand Adapted to Shifting Customer Habits Amid COVID-19 with Clootrack